Understanding Total Cost of Ownership in Procurement Management

Dec 19

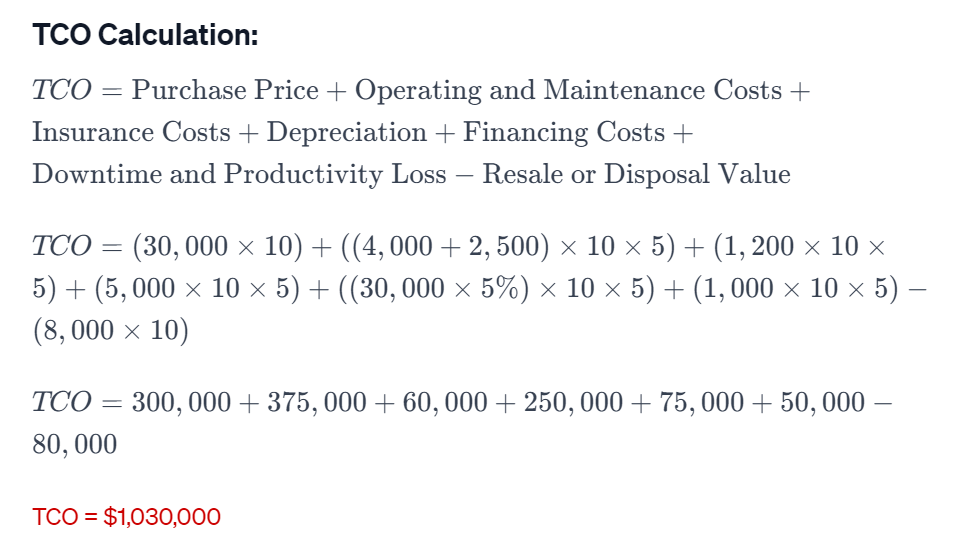

Total Cost of Ownership (TCO) in procurement management is a comprehensive approach to evaluating and understanding all costs associated with acquiring, owning, and managing a product or service throughout its entire life cycle. TCO goes beyond the initial purchase price and includes various direct and indirect costs that may arise during the procurement process and the subsequent use of the product or service. The goal is to make more informed purchasing decisions by considering the long-term impact on an organization's finances and operations. Let's go through a detailed example to illustrate the concept of Total Cost of Ownership.

What is Total Cost of Ownership (TCO)?

TCO is the overall cost incurred to acquire, maintain, and dispose of a product or service over its complete lifecycle. It is relatively simple to calculate the purchase price of a product or service, but the TCO provides a more comprehensive view of the total cost involved rather than just the purchase price. It helps to identify all the costs involved in a procurement process and is critical in evaluating the value of different options in a procurement process.

The TCO consists of several factors, including the acquisition cost, installation cost, operational cost, maintenance cost, repair costs, replacement cost, and disposal cost. For instance, in a procurement process, the acquisition cost could be negotiated at a lower price, but if the installation cost is high, the overall TCO would increase.

The TCO consists of several factors, including the acquisition cost, installation cost, operational cost, maintenance cost, repair costs, replacement cost, and disposal cost. For instance, in a procurement process, the acquisition cost could be negotiated at a lower price, but if the installation cost is high, the overall TCO would increase.

Example: TCO Analysis for a Fleet of Delivery Vehicles

Step 1: Initial Purchase Price

Step 3: Insurance Costs

Step 4: Depreciation

Step 5: Financing Costs

Step 6: Downtime and Productivity Loss

Step 7: Resale or Disposal Value

- The organization plans to purchase a fleet of delivery vehicles to support its distribution operations.

- The initial purchase price per vehicle is $30,000, and the organization plans to buy 10 vehicles.

Step 2: Operating and Maintenance Costs

- Consider ongoing operating and maintenance costs over the expected life span of the vehicles, which is 5 years.

- Annual fuel costs per vehicle: $4,000

- Annual maintenance costs per vehicle: $2,500

Step 3: Insurance Costs

- Include insurance costs associated with the fleet.

- Annual insurance cost per vehicle: $1,200

Step 4: Depreciation

- Factor in the depreciation of the vehicles over the 5-year period.

- Depreciation per vehicle per year: $5,000\

Step 5: Financing Costs

- If the organization finances the purchase through a loan, consider the interest payments.

- Annual interest rate on the loan: 5%Loan term: 5 years

- Financing cost per vehicle per year: $1,500

Step 6: Downtime and Productivity Loss

- Evaluate potential downtime and productivity loss due to maintenance or unexpected breakdowns.

- Estimated cost of downtime per vehicle per year: $1,000

Step 7: Resale or Disposal Value

- Estimate the resale or disposal value of the vehicles at the end of their useful life.

- Estimated resale value per vehicle: $8,000

Interpretation:

The Total Cost of Ownership for the fleet of delivery vehicles over a 5-year period is $1,030,000.

This comprehensive calculation provides a more accurate representation of the financial impact of owning and operating the vehicles compared to just considering the initial purchase price. The organization can use this information to make more informed decisions, considering not only the acquisition cost but also the long-term costs associated with the fleet. It may also help in evaluating different procurement options, such as exploring more fuel-efficient vehicles, negotiating better maintenance contracts, or considering alternative financing options to optimize the overall cost of ownership.

This comprehensive calculation provides a more accurate representation of the financial impact of owning and operating the vehicles compared to just considering the initial purchase price. The organization can use this information to make more informed decisions, considering not only the acquisition cost but also the long-term costs associated with the fleet. It may also help in evaluating different procurement options, such as exploring more fuel-efficient vehicles, negotiating better maintenance contracts, or considering alternative financing options to optimize the overall cost of ownership.

Subscribe to our newsletter

Thank you!

Important Links

-

Courses

-

Pricing

-

FAQ

-

Hire

-

Internships

-

Webinars

-

Community

-

Become a Mentor

-

Blog

-

Data Science & AI in SCM

Compare Us

-

Upskill Utopia Vs Udemy

-

Upskill Utopia Vs Coursera

-

Upskill Utopia Vs Upgrad

Let's Work Together

Join our member club today and get expert guidance from industry leaders

Thank you!